CNAT

Te pego el de Avisol Capital primero, que creo que es el que la está haciendo girarse ahora, y luego el otro

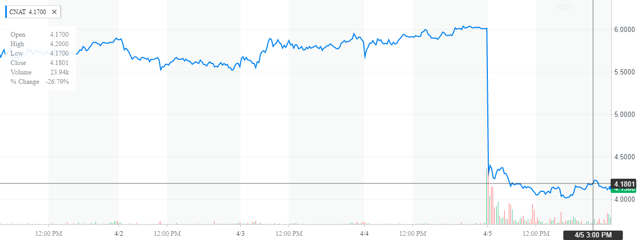

Conatus (NASDAQ:

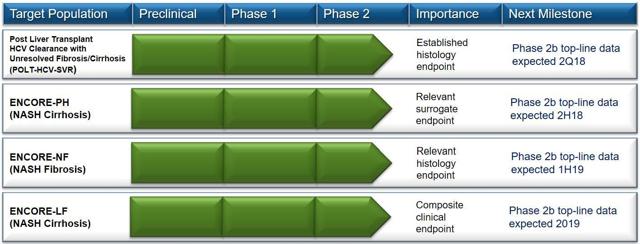

CNAT) shares tumbled after the company announced top-line results from a phase 2b POLT-HCV-SVR clinical study. The phase 2b study was evaluating CNAT’s lead product candidate emricasan, a first-in-class pan-caspase protease inhibitor designed to reduce the activity of human caspases in liver transplant patients with fibrosis or cirrhosis. It is one of the four studies CNAT is currently conducting with its lead product candidates. The most anticipated data will be from the ENCORE-LF study (due in the second half of 2019).

We covered CNAT as part of our NASH series back in February. As we had noted back then, what makes emricasan exciting is the fact that it is targeting a spectrum of the NAFLD/NASH disease where the space is not yet crowded. A majority of NASH players are focusing on NASH fibrosis. With emricasan, Conatus is targeting a full range of fibrosis and cirrhosis, including decompensated cirrhosis. Currently, none of the NASH players are targeting NASH with decompensated cirrhosis. This makes the results from the ENCORE-LF trial very important.

The POLT-HCV-SVR study did not meet the primary endpoint in the heterogeneous overall trial population, the emricasan treatment effect in the subgroup of patients where the histology endpoint is most relevant. Patients with advanced fibrosis and early cirrhosis supports further evaluation. While this is a setback for CNAT, it must be noted that this study has a separate patient population vs. the other three Phase 2b clinical trials in the company’s collaboration with Novartis (NYSE:

NVS), which are in non-viral indications in patient populations with nonalcoholic steatohepatitis (NASH) fibrosis or cirrhosis. As we also noted, the ENCORE-LF study is the most important for CNAT.

We believe that the sell-off creates a good opportunity to add some CNAT shares, which had a good run in March before the sell-off in the broader market.

https://seekingalpha.com/article/4161439-daily-pharma-scoop-conatus-setback-applied-dna-signs-agreement-evolus-announces-results-late?app=1&uprof=44&isDirectRoadblock=false

El de Bret:

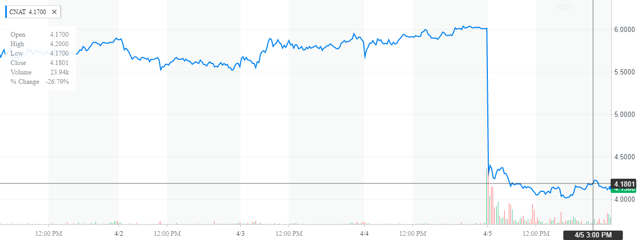

Thursday was not a good day for shareholders of

Conatus Pharmaceuticals (

CNAT). The shares plunged some 30% on the trading day. The trigger for the decline was disappointing trial results from a key candidate in this '

Tier 4' concern's pipeline.

Specifically, the company's primary drug candidate 'Emricasan' had an unsuccessful POLT-HCV-SVR proof-of-concept

clinical trial (Phase 2B), in liver transplant patients with fibrosis or cirrhosis. The company did say that the data for a subgroup of patients where this endpoint is most relevant supported 'further evaluation'.

So where does this leave investors in this small 'Tier 4' concern?

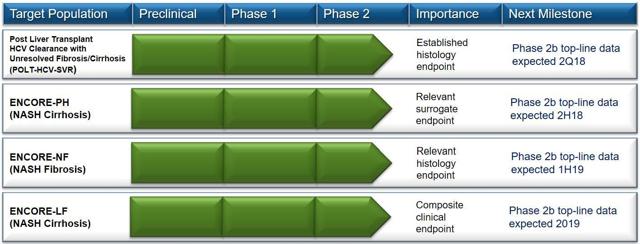

Source: Company Website

First, it is important to remember that this was one of several trial milestones due to hit over the next year or so. The next reading should be top line Phase 2 data for NASH Cirrhosis that should be out in the back half of 2018.

In addition, the analyst community has not given up on Conatus despite this setback. Here is a sampling of analyst opinions that have came out since this disappointing data came out. Oppenheimer

reissued their Outperform rating yesterday and cut slightly its price target on Conatus to $14 from $16 previously. This is what Oppenheimer's analyst had to say about his view on CNAT after these study results.

Despite the lack of clarity around F6 patients in POLT, we remain optimistic about the next catalyst for CNAT which is top-line results for the Ph2 NASH study, ENCORE-PH, in 2H18. We believe the POC established for emricasan anti-fibrotic activity in POLT provides confidence for ENCORE-PH because this study also includes fibrotic and cirrhotic patients. As it is the leader of caspase inhibition, we believe CNAT presents a unique opportunity for investors to participate in the potential of a broadly applicable treatment for liver diseases including NASH"

H.C. Wainwright also

lowered its price target from $17 to $15 yesterday while maintaining its enthusiasm on the name and Buy rating. Here is what Wainwright's analyst had to say about the company's post-trial prospects

In our view, the share price drop is an over-reaction to the top-line POLT miss, as we believe: 1) investor expectations were fairly low; and 2) investor focus is primarily on the expected 1H19 readout of ENCORE-LF (we and others have long regarded POLT as a niche “wild card” opportunity).”

Others Chime In:

I posted a poll on my

Twitter handle on the future of Conatus as well as its stock after the shares plunged yesterday. Here are the results (informal as they may be)

23% - Beginning of the End

44% - A Buying Opportunity

21% - Too Early to Tell

12% - A Major Setback

As you can see opinions vary widely as one might expect after a trial setback. More importantly, the company has an important collaboration partner on this program with

Novartis (

NVS) who made a substantial upfront payment to become Conatus' development partner on this program and is also on the hook for significant milestone payments and royalty payouts should emricasan development lead to success.

I have a decent position in Conatus which fortunately was completely hedged with covered calls when this news hit. I have a full stake in this developmental concern. Therefore, I do not plan to add to my holdings at this time. Nor will I be selling as the company has several 'shots on goal' left and has trial milestones upcoming over the next year which could improve sentiment on the stock.

The company ended 2017 with approximately $75 million in cash and marketable securities on the balance sheet. The fourth quarter saw just over $13 million in spend on R&D and other operational expenses. Management provided this guidance on its fourth quarter

conference call

The company believes that current financial resources, together with the anticipated reimbursements for 50% of the costs for the four ongoing clinical trials, without including any potential milestone payments under the Novartis collaboration, are sufficient to maintain operations through top-line results from all four Phase 2b clinical trials by the end of 2019, as well as to fund initial pipeline expansion activities".

After yesterday's sell-off, the stock has an approximate market cap of $125 million which seems more than cheap given cash on hand and the potential of Emricasan.

Option Strategy:

If I wanted to establish an initial stake or increase exposure to Conatus Pharmaceuticals; I would do so via a

Buy-Write option strategy. Using the October $5 call strike, fashion a Buy-Write order with a net debit of between $3.30 to $3.50 a share (net stock price - option premium). This mitigates some downside and sets up a more than solid potential return for its under seven month 'hold' period.

The government says law, but they mean levy.” ― Amit Kalantri, Wealth of Words

https://seekingalpha.com/instablog/498952-bret-jensen/5140578-next-4-potential-nash-play

«Después de nada, o después de todo/ supe que todo no era más que nada.»