Esto sale sobre Dia en el Financial Times, para el que sepa inglés:

Spanish supermarket group Dia faces crunch time

Struggling chain enters crucial period as investors ponder turnround potential

The chairwoman and chief executive have resigned, the head of finance has been fired, while the company’s dividend has been slashed and its debt downgraded to junk. It has been a grim few months for Dia Group, the Spanish supermarket chain. The bad news has crushed the group’s shares, which have this year plummeted more than 80 per cent to under €0.70, and pushed down the company’s long-term debt to around half its face value. “Dia is facing its toughest test since its listing in 2011,” said chief executive Antonio Coto, the former head of Dia’s South American operations who was named in August to replace longtime head Ricardo Currás, on a recent earnings call. “The truth is we’ve got left behind.” The question now on the lips of analysts and investors is whether Spain’s third-largest grocery chain can turn itself round. There are some reasons for hope. Today, Dia and its franchisees have a huge network of more than 7,400 stores across Spain, Portugal, Brazil and Argentina — many in prime locations. Its store format has proved successful with consumers. Its first one in Madrid in 1979 launched the discount convenience model in Spanish food retail. While the group expanded into hypermarkets as the economy boomed, it largely stayed focused on convenience stores, currently in vogue.

“Consumer habits play in favour of Dia,” said Gildas Aïtamer, an analyst at LZ Retailytics, a retail consultancy. He believes convenience store formats are what consumers want. In its last earnings report, Dia said that its newly converted Dia&Go convenience stores, with more modern design, ready-to-eat food, and longer opening hours, showed 22 per cent like-for-like growth. LZ Retailytics expects discount and minimarket stores to grow by 4.5 per cent annually over the next five years, compared with 2.8 per cent for other grocers in Spain. But Dia’s greatest hope may be Russian billionaire Mikhail Fridman’s holding company, LetterOne, which through its L1 Retail fund has the biggest stake in Dia with a holding of 29 per cent.

Some think it is possible Mr Fridman will launch a bid for complete control of the group as he seeks to step up his attempts to revive it. Indeed, LetterOne has hired Paul J Taubman’s PJT Partners to recapitalise Dia through a capital increase and to investigate a possible takeover, according to Spanish financial daily elEconomista. A spokesperson for the Madrid office of PJT Partners confirmed that it had been contracted to “study different restructuring scenarios” but declined to comment on those options. With Mr Fridman’s experience in retail, having built X5 Retail Group into Russia’s biggest food retailer with more than 13,000 stores, some analysts believe he is the key to a turnround. An L1 Retail spokesperson said: “We bought into the company believing in its potential and that we could bring to Dia’s board, through our L1 Retail representatives, unparalleled retail experience.”

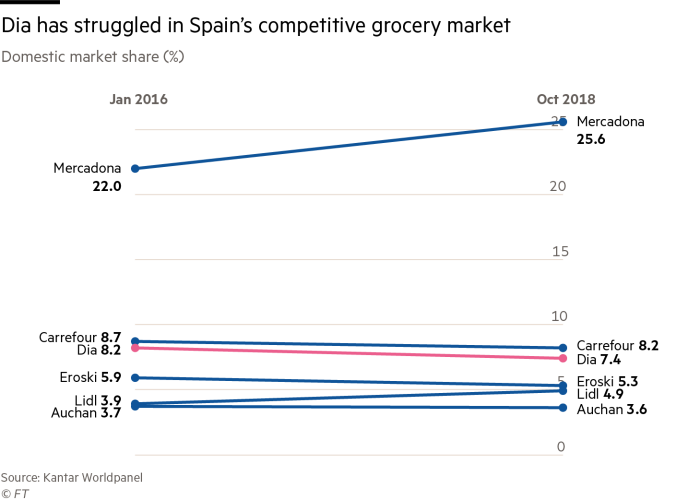

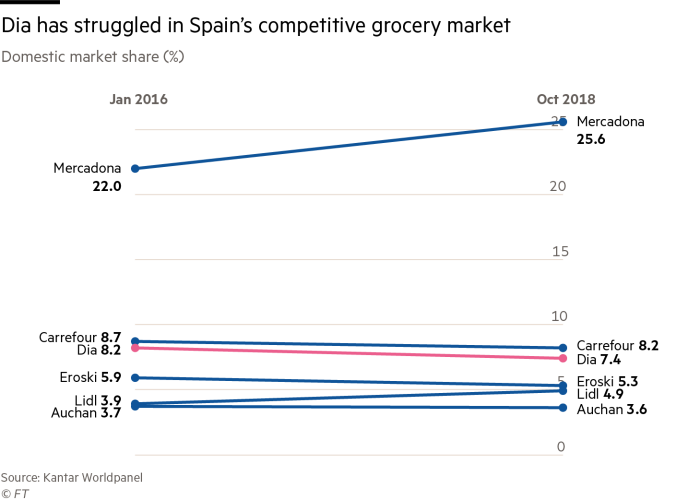

Others, however, think that the presence of the Russian tycoon and L1’s retail-savvy Dia board members, including X5 chairman Stephan DuCharme and former Lidl chief executive Karl-Heinz Holland, may not be enough. Spain’s grocery market has become increasingly competitive, with local heavyweight Mercadona’s growth (it has 25 per cent of the market) and the expansion of German discount chain Lidl — private companies that can more easily compete on price than Dia. They are also much bigger than their publicly listed rival. “The problem has more to do with what Lidl and Mercadona have done than with what Dia has done,” said Vincent Gusdorf, analyst at credit rating agency Moody’s, which downgraded Dia’s debt to junk. “If you’re competing with companies that are two-to-three times bigger and they decide to lower their margins, you’re in trouble.”

Additionally, competitors’ stores are newer as their expansion has been more recent. This has created problems for Dia. “All of a sudden, for every Dia store, you have all these new stores with attractive propositions. Dia had to react to that,” said Eduardo Giménez, a partner in the consumer goods practice at consultancy Bain & Co. “They have to renew the stores, and that takes time and money. And that has an effect on their ability to grow.” But by far the greatest problem Dia faces is debt. With net debt of €1.42bn at the end of September, Mr Gusdorf at Moody’s said that Dia’s net debt to earnings before interest, tax, depreciation and amortisation ratio will probably exceed the 3.5 times limit required by its credit facilities. The company has a €306m bond due in July 2019.

o avoid breaking its covenants, Mr Coto said the company was looking to sell its Clarel home and beauty chain. But that may not be enough to avoid a renegotiation of its debt, which Dia management is attempting, or a dilutive capital raise. For now, investors and analysts are waiting on whether Mr Fridman will make a move for complete control, which could prove to be the decisive moment for the company’s turnround or just another footnote in its miserable fortunes. “Recent events at Dia are surprising and disappointing but do not detract from the long-term potential of Dia in the Spanish food retail space,” said the L1 Retail spokesperson, before adding: “So long as all stakeholders continue to support the company.” The big question is: will these stakeholders continue to find reasons to do so? Additional reporting by Robert Smith in London

https://www.ft.com/content/9192ca22-e7f9-11e8-8a85-04b8afea6ea3