Summary

- Kors has been crushed in recent weeks off of weak guidance issued during its Q4 report.

- But I still believe Kors has significant growth ahead of it.

- At 10.5 times forward earnings estimates, it is too cheap to ignore.

Back in January I called the once-hot retailer stock of Michael Kors (NYSE:KORS) a value with 20%+ EPS growth. I've been bullish on KORS for about a year now, a position that has unfortunately been quite frustrating. Kors continues to get pummeled and despite multiple rally attempts, cannot seem to get out of its own way. The stock was recently hammered on weak guidance a few weeks ago and is now trading with a 4 handle again, something that hasn't happened for about two years. In other words, things are bad for Kors so in this article, I'll take a fresh look and see if perhaps there is still some value to be had or if I should abandon my bull call after substantial losses.

(click to enlarge)

To do this I'll use a DCF-type model you can read more about here. The model uses several inputs including earnings estimates, which I've borrowed from Yahoo!, dividends, which I've set to zero forever, and a discount rate, which I've set at the 5 year Treasury rate plus a risk premium of 7%.

2015

2016

2017

2018

2019

2020

2021

Earnings Forecast

Prior Year earnings per share

$4.28

$4.33

$4.61

$5.09

$5.63

$6.21

x(1+Forecasted earnings growth)

1.20%

6.50%

10.43%

10.43%

10.43%

10.43%

=Forecasted earnings per share

$4.33

$4.61

$5.09

$5.63

$6.21

$6.86

Equity Book Value Forecasts

Equity book value at beginning of year

$11.22

$15.55

$20.16

$25.26

$30.88

$37.10

Earnings per share

$4.33

$4.61

$5.09

$5.63

$6.21

$6.86

-Dividends per share

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

=Equity book value at EOY

$11.22

$15.55

$20.16

$25.26

$30.88

$37.10

$43.96

Abnormal earnings

Equity book value at begin of year

$11.22

$15.55

$20.16

$25.26

$30.88

$37.10

x Equity cost of capital

8.73%

8.73%

8.73%

8.73%

8.73%

8.73%

8.73%

=Normal earnings

$0.98

$1.36

$1.76

$2.21

$2.70

$3.24

Forecasted EPS

$4.33

$4.61

$5.09

$5.63

$6.21

$6.86

-Normal earnings

$0.98

$1.36

$1.76

$2.21

$2.70

$3.24

=Abnormal earnings

$3.35

$3.26

$3.33

$3.42

$3.52

$3.62

Valuation

Future abnormal earnings

$3.35

$3.26

$3.33

$3.42

$3.52

$3.62

x discount factor(0.0873)

0.920

0.846

0.778

0.715

0.658

0.605

=Abnormal earnings disc to present

$3.08

$2.75

$2.59

$2.45

$2.31

$2.19

Abnormal earnings in year +6

$3.62

Assumed long-term growth rate

3.00%

Value of terminal year

$63.20

Estimated share price

Sum of discounted AE over horizon

$13.19

+PV of terminal year AE

$38.25

=PV of all AE

$51.44

+Current equity book value

$11.22

=Estimated current share price

$62.66

We can see here that the model is still bullish on Kors, projecting a fair value of almost $63. That's a very long way from today's price so let's take a look at the fundamentals to see if they paint the same bullish picture.

When Kors reported in late May the initial reaction from investors was one of ambivalence; the stock was hanging around the flat line as investors digested nearly 18% revenue growth and a small miss on the EPS line. The quarter looked a lot like many others we've seen from Kors in the past but then, Kors issued its guidance and that's when things got ugly.

The company said total revenue grew on a constant currency basis by more than 23% and while this is terrific to be sure, we all know that "constant currency" doesn't really matter; forex losses are real losses and they matter. The good news is that it gives us a read into what a normalized Kors would look like with less dollar strength.

I think what really spooked investors was the comp sales numbers Kors produced which - by any measure - were really awful. North America saw a 5.8% constant currency decline and with this being the company's largest market, this hurt the most. What I found interesting was the sheer magnitude of the dollar's impact on Kors' international results; the difference between reported comp sales and constant currency comp sales for Europe and Japan, respectively, were 16.6% and 17.6%. Admittedly, these two markets are collectively a fraction of North America but the impact of the dollar is massive for Kors.

On the margin front, Kors showed some weakness as well. Gross margins were down in FQ4 150 bps YoY with about 30 bps of that coming from currency fluctuations. That means Kors ceded 120 bps of margin based upon other things like sourcing and weak pricing. That isn't good even though Kors' margins are still massive at nearly 60%; when a retailer begins losing margins it can be the canary in the coal mine and when coupled with weak sales, can be a negative cycle that produces staggering EPS losses.

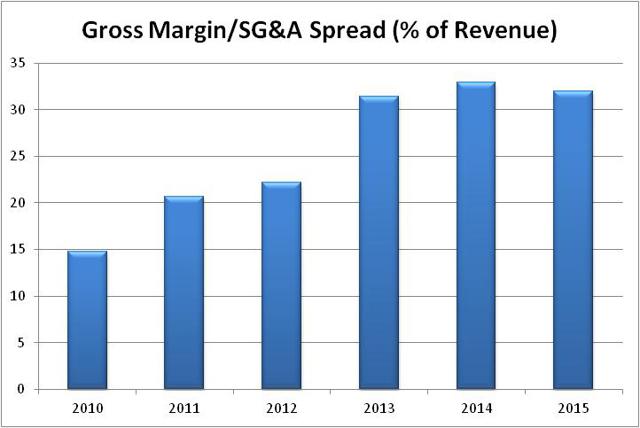

Taking the longer view, one of my favorite metrics for a retailer is comparing its gross margins against its SG&A costs. By doing this we can see both pricing trends and cost controls in a single metric that gives us a quick measure of operating profits. I've charted this metric for Kors since 2010 below.

(click to enlarge)

We can see that as Kors has grown its revenue base the company has achieved terrific scale on its SG&A expenditures. In fact, Kors' spread is more than double what it was in fiscal 2010 when it produced about $500 million in revenue, a fraction of FY2016's $4.7 billion estimate. This has allowed Kors to grow its profits at a staggering rate in the past but the problem, as you can see, is that the growth in this spread halted in FY2015. That can pose a problem going forward if Kors cannot expand operating margins once again.

It appears this will not happen in FY2016 as Kors provided specific guidance for us during its Q4 report. Management said operating expenses as a share of revenue will increase 110 to 140 bps over 2015, indicating that since gross margins are flat to down, we'll see operating profits down markedly as a percentage of revenue this year. That means investors were probably right to move the stock down on earnings but given what else was in the report, I happen to think the move down was exaggerated.

What's interesting to me is that Kors provided guidance that analysts seemingly don't believe. Kors is saying it can hit $4.7 to $4.8 billion in revenue; analysts have it at $4.71 billion, well below the midpoint. Kors also said it will hit $4.40 to $4.50 in EPS this year; analysts have it at $4.33. In other words, analysts are telling the market that they do not believe the guidance that was just issued by Kors and apparently the market agrees; the stock is down way too much if Kors' guidance is right.

The beauty of this is that the stock is already pricing in a guidance cut from Kors, increasing the odds that the stock is a value at these levels. Since pessimism reigns right now pressing from the short side seems like the wrong move to make; even if Kors gets close to its own guidance, the stock should move up.

Something I think investors are also forgetting is that Kors still has about $1 billion left on its share repurchase program, good for more than 10% of the current float. And given that Kors is actually quite judicious in its issuance of new shares, that billion dollars will go a long way towards reducing the share count. This should prove to be a sizable tailwind for earnings in the coming quarters and should make Kors' guidance much easier to hit.

Kors' guidance contains tremendous expenditures, mainly in the first half of the year, to fund growth in the future. Kors is in the stage many retailers have been in before which is one where the rapid start-up levels of growth are done and the company is outpacing its ability to continue to service customers. In other words, Kors needs to invest in people and infrastructure in order to continue to grow in the future from its current level; if you believe management's guidance this will prove to be a good thing over the long term.

Kors shares have been absolutely crushed in the past few quarters and for good reason; the company did not live up to expectations set by the market. However, that doesn't mean the stock should be left for dead. The stock is now trading for 10.5 times forward earnings, a multiple better suited for a bank stock than a high growth retailer. And that number assumes the more pessimistic analyst expectations of EPS; Kors' own guidance would have that number even lower. For a retailer with a strong brand following that is still in growth mode, I just can't justify that level for an earnings multiple. I think Kors is simply too cheap to ignore at this point and that later this year, investors will wish they bought the stock at $48.