Northern Star Resources

Considering Earnings Growth, Is The Market Undervaluing Northern Star Resources Limited (ASX:NST)?

Alex Johannesen January 4, 2017

With a history of sound earnings growth, Northern Star Resources Limited’s (ASX:NST) valuation appears to be in the sweet spot as the company sports a PE ratio of 13.3, while the market agrees on placing its industry at a PE of 32.4.

See our latest analysis for NST

How does Northern Star Resources fare in relative valuation?

One of the easiest ways to compare a company’s valuation relative to its industry is the PE ratio. While there is no set definition of what an acceptable PE should be, popular opinion is that a value of over 30 may get you in trouble. But there are always exceptions, such as high growth potential companies, primarily in the technology sector. Investors pay well beyond the 30-mark based on their steep growth projections.

Industries have different profitability due to inherent differences in their business models, as a result, price-to-earnings ratio is more of an industry specific measure. As Northern Star Resources’s price-to-earnings of 13.3 lies below the industry average of 32.4, either NST is losing out to other companies or the market has mispriced the company. But answers to questions like how it has performed in the past versus the industry and how the analysts covering company view the earnings going forward may just help put its valuation in the right perspective.

Solid past performance

The focus of investing community shifts to a company’s bottom-line after a few years of operations. No matter how much it grows the sales, it’s the bottom line which decides the payback period and return on an investor’s investment. NST delivered an impressive annual average earnings growth rate of 37% over the past five years. Its past growth rate would easily lie in the upper-end of the most mature and late-stage-growth industries.

ASX-NST-income-statement-Wed-Jan-04-2017

Apart from the sound long-term track record, Northern Star Resources recorded a higher earnings growth of 49.9% during the past 12 months compared to the industry average of 29.1%. That indicates it has a competitive advantage with respect to the other companies in the industry. As different industries are affected by the economic cycle and they may perform well during a specific phase, it’s interesting to note how a company under consideration fares in that industry.

What are the future expectations?

Any firm’s profitability can be adversely, or favourably, affected by both the actions of the firm and changes in the environment it operates in. Inside the firm, the management is a key consideration when trying to work out forward looking performance figures. Savvy investors do analyse all the contingencies related to a company. But analysts, who are also seen interacting with the management on a regular basis, provide estimates using in-depth analysis of factors affecting the company. The mean of these estimates can be considered a fair representation of a company’s performance going ahead.

Investors in Northern Star Resources have been patiently waiting for the uptick in earnings and if you believe the 8 analysts covering the stock then the next 3 years will be very interesting. The estimates for earnings per share range from $0.46 to $0.73 with an average expectation of 96.4% growth.

ASX-NST-past-future-earnings-Wed-Jan-04-2017

Conclusion

Considering Northern Star Resources’s track record, expected earnings growth, and the price-to-earnings ratio, it appears to be trading at a reasonable valuation. There are other fundamental considerations related to its balance sheet and dividend history, which may change an investor’s perspective – See our latest analysis to find out!

Investors! Do you know the famous “Icahn’s lift”?

Noted activist shareholder, Carl Ichan has become famous (and rich) by taking positions in badly run public corporations and forcing them to make radical changes to uncover shareholders value. "Icahn lift" is a bump in a company's stock price that often occurs after he has taken a position in it. What were his last buys? Click here to view a FREE detailed infographic analysis of Carl Icahn’s investment portfolio.

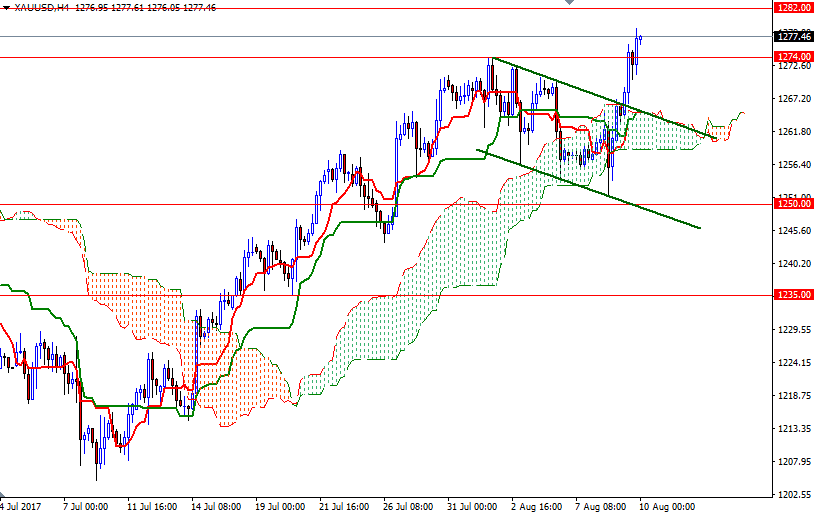

Grafico cotización, alcista